There are a few which see the roots of a serious recession based upon a collapse in housing prices and a manufacturing slump.Īnd then there is the lonely middle where I reside, which sees a mild recession (at least by historical standards). – not an easy task within a single country and an even more daunting one within the euro area.įorecast 2007: The Goldilocks Recession, John Mauldin This only needs to be temporary until monetary and fiscal policy can again be separated, but in the meantime the situation requires sharing information, thoughts and plans The interrelated character of current policy actions implies that exit requires an unusual degree of coordination between governments and central banks. Budget deficits in several countries have entered unknown territory (at least in peace time) and central bank balance sheets bear no resemblance to what they were two years ago. Whether or not they are deemed appropriate and sufficient, actions taken by governments and central banks to support banks and stimulate the economy are genuinely extraordinary. I know I must sound like a broken record, but it bears repeating: If the cause of the bubbles was EASY credit and excessive money creation that eventually burst and brought us to where we were on March 9, 2009, how can doing more of the same produce anything else besides more of the same?Įxit strategies, in other words: when and how will economic policy return to normality? The Goldilocks Economy, the BEARS always come home. The name that was popular the last time we were in this same position: Today, there is no danger of rate rises but investors are instead looking to the Fed to protect them from the bears. That meant the Federal Reserve did not take away the punch (or should that be porridge?) bowl from equity investors. Throughout the late 1990s and mid-2000s the US economy benefited from the perfect “Goldilocks” scenario: not too hot, not too cold.

The gap between the highest and lowest growth forecasts is down to levels last seen at the height of the credit bubble in 2007, and before that at the end of the dotcom boom.

But the consensus is dangerously, well, consensual.

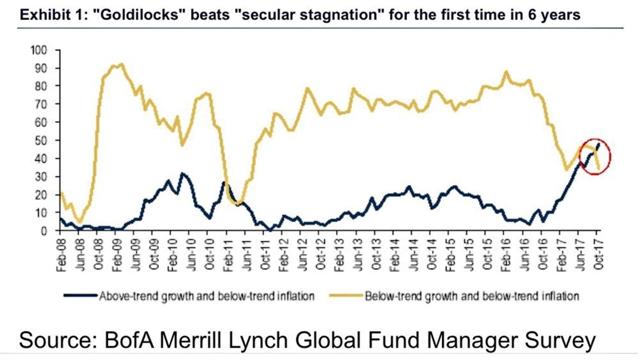

With growth forecast to be close to 3 per cent, but inflation just 1.6 Investors are hoping for a Goldilocks outcome for the US economy, Lars Christensen, Bloomberg 2 February 2018īuttonwood, The Economist print 7 December 2017 Meaning there is a greater probability inflation the will rise above the Fed's target than stay below. Our monetary indicator has recently risen above zero, The Market's Goldilocks Era Is Nearing an End

0 kommentar(er)

0 kommentar(er)